Sara England was in the midst of preparing Ghostbusters costumes for Halloween when she noticed her baby wasn't doing well.

Her 3-month-old son, Amari Vaca, had recently undergone open-heart surgery, so she contacted his cardiologist, who advised her to have him checked out. England then asked Amari's grandparents to take his three older siblings trick-or-treating and rushed to the local emergency room.

Upon arriving at Natividad Medical Center in Salinas, California, England mentioned that doctors quickly recognized Amari's breathing difficulties and informed her that he required immediate specialized care at one of two major hospitals in the area, whichever had an available opening first.

As they discussed the situation, Amari's condition worsened rapidly, his mother recounted. Medical professionals inserted a tube to assist his breathing and manually provided oxygen with a bag for over an hour until he stabilized enough to be put on a ventilator.

Later that night, England shared that once doctors deemed Amari fit for transport, his medical team informed her that a bed had become available at the University of California-San Francisco Medical Center and that their staff was prepared to admit him.

A Mother, Her Son, and an Expensive Plane Ride

Once upon a time, a mother, her son, and an EMT embarked on a late-night journey aboard a small plane. Ground ambulances shuttled them between hospitals and airports, all in the name of medical care.

The young boy, Amari, had been battling respiratory syncytial virus (RSV) and after a three-week hospital stay, he finally conquered the illness and returned home.

But then came the dreaded bill.

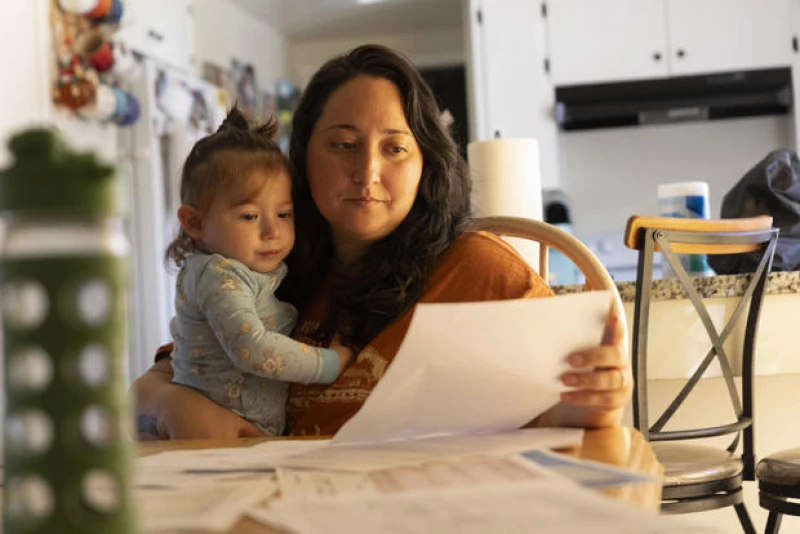

The Patient: Amari Vaca, now 1 year old, covered by a Cigna policy sponsored by his father's employer at the time.

The Costly Journey

Medical Services: An 86-mile air-ambulance flight from Salinas to San Francisco.

Service Provider: Reach Medical Holdings, a part of the industry giant Global Medical Response, supported by private equity investors. Despite operating in all 50 states and owning 498 helicopters and airplanes, it remains out-of-network with Amari's Cigna plan.

Total Bill: $97,599. Cigna refused to cover any portion of the bill.

What Happened: While legal protections exist to shield patients from hefty bills for certain out-of-network services like air-ambulance rides, Amari's family was still hit with a $97,000 "balance bill." The experts suggest that the No Surprises Act, a federal law passed in 2022, could have prevented this, requiring the insurer and the air-ambulance provider to negotiate a fair payment based on the law. However, these protections only cover care deemed "medically necessary" by health plans, with insurers having the final say on what that entails in each scenario.

According to the denial letter from Cigna, Amari's air-ambulance trip was deemed not medically necessary. The insurer's rationale was that he could have used a ground ambulance for the almost 100-mile journey between Salinas and San Francisco.

"I couldn't believe it," England expressed. "We can't afford this. Is this really happening?"

The letter stated that Amari's medical records did not indicate that other modes of transportation were not feasible or medically necessary. Additionally, there was no documentation showing that he was inaccessible by ground ambulance or that such transportation was impractical due to long distances or obstacles.

Furthermore, it mentioned that the records did not demonstrate that a ground ambulance would hinder timely and appropriate medical treatment.

When asked by KFF Health News about the specific records considered in the decision, a Cigna spokesperson declined to comment.

Caitlin Donovan, a representative for the National Patient Advocate Foundation, pointed out that while Amari's bill technically complies with the No Surprises Act, the situation goes against the law's intended purpose.

"Essentially, they are suggesting that the parents should have disregarded the physician's advice," Donovan remarked. "It's absurd. 'Medical necessity' may be vague, but it appears to be used as a blanket reason to deny patients."

On February 5, a recent report highlighted concerns raised by the National Association of Emergency Medical Services Physicians regarding claim denials based on "lack of medical necessity" following the implementation of the No Surprises Act two years ago. The denials were primarily related to air-ambulance transports between facilities.

In response to these issues, the association urged federal health officials to establish a presumption of medical necessity for inter-facility air transports ordered by a hospital physician, with a provision for retrospective review.

The president of the group, José Cabañas, emphasized the critical nature of these decisions, stating that they are often made in urgent situations where a hospital lacks the resources to stabilize a patient, and should not be questioned by health plans.

Health policy expert Patricia Kelmar suggested that hospitals could mitigate these challenges by proactively familiarizing themselves with local health plans and establishing protocols to determine in-network alternatives before resorting to air ambulances.

"The hospitals who live and breathe and work in our communities should be considering the individuals who come to them every day," Kelmar said. "I understand in emergency situations you generally have a limited amount of time, but, in most situations, you should be familiar with the plans so you can work within the confines of the patient's health insurance."

England said Cigna's denial particularly upset her.

"As parents, we did not make any of the decisions other than to say, yes, we'll do that," she said. "I don't know how else it could have gone."

The Resolution

England twice appealed the air-ambulance charge to the insurer, but both times Cigna rejected the claim, maintaining that "medical necessity" had not been established.

The final step of the appeals process is an external review, in which a third party evaluates the case. England said staff members at Natividad Medical Center in Salinas — which arranged Amari's transport — declined to write an appeal letter on his behalf, explaining to her that doing so is against the facility's policy.

Using her son's medical records, which the Natividad staff provided, England said she is writing a letter herself to assert why the air ambulance was medically necessary.

Andrea Rosenberg, a spokesperson for Natividad Medical Center, said the hospital focuses on "maintaining the highest standards of health care and patient well-being."

Despite receiving a waiver from England authorizing the medical center to discuss Amari's case, Rosenberg did not respond to questions from KFF Health News, citing privacy issues. A Cigna spokesperson told KFF Health News that the insurer has in-network alternatives to the out-of-network ambulance provider, but — despite receiving a waiver authorizing Cigna to discuss Amari's case — declined to answer other questions.

"It is disappointing that CALSTAR/REACH is attempting to collect this egregious balance from the patient's family," the Cigna spokesperson, Justine Sessions, said in an email, referring to the air-ambulance provider. "We are working diligently to try to resolve this for the family."

On March 13, weeks after being contacted by KFF Health News, England said, a Cigna representative contacted her and offered assistance with her final appeal, the one reviewed by a third party. The representative also told her the insurer had attempted to contact the ambulance provider but had been unable to resolve the bill with them.

Global Medical Response, the ambulance provider, declined to comment.

England said she and her husband have set aside two hours each week for him to take care of their four kids while she shuts herself in her room and makes calls about their medical bills.

"It's just another stress," she said. "Another thing to get in the way of us being able to enjoy our family."

The Takeaway

Kelmar emphasizes the importance of patients appealing bills that appear to be inaccurate. Even if the insurance plan rejects the appeal internally, she advises pushing for an external review so that an independent party can assess the situation.

In instances where claims are denied due to "medical necessity," Kelmar suggests collaborating with the healthcare provider to offer additional information to the insurance company, highlighting why the emergency transport was essential.

Physicians can also intervene by writing a letter or contacting a patient's insurer to request a "peer-to-peer review," where they can discuss the case with a medical specialist in the relevant field.

Kelmar also recommends that patients with employer-sponsored health plans involve their company's human resources department in advocating for them with the health plan. This is beneficial for employers as they invest significantly in these health plans.

Above all, Kelmar advises patients not to be deterred by fear when it comes to challenging a medical bill. She notes that those who appeal have a strong chance of success.

Individuals with government health coverage can escalate insurance denials by submitting a complaint to the Centers for Medicare & Medicaid Services. Those who believe they have received an improper bill from an out-of-network provider can contact the No Surprises Act help desk at 1-800-985-3059.

This news piece was crafted by KFF Health News, a publisher of California Healthline, an independent editorial service of the California Health Care Foundation.

KFF Health News (formerly referred to as Kaiser Health News, or KHN) operates as a national newsroom that specializes in in-depth reporting on health matters. Alongside Policy Analysis and Polling, KHN stands as one of the primary operational divisions at KFF (Kaiser Family Foundation). KFF, an endowed nonprofit organization, delivers health-related information to the public.