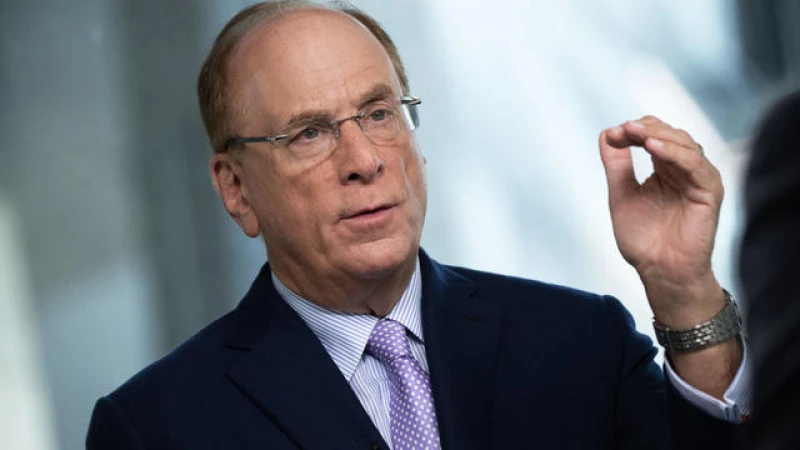

BlackRock CEO Larry Fink highlighted in his annual shareholder letter that the changing demographics in the United States are placing significant pressure on the country's retirement system as Americans live longer and spend more years in retirement.

To address this issue, Fink proposes that Americans should consider working for a longer period before retiring. He questioned the traditional retirement age of 65, stating that it dates back to the time of the Ottoman Empire and may no longer be suitable given the current circumstances.

As the debate on the future of Social Security intensifies, with projections indicating a funding shortfall in less than ten years, some Republican lawmakers have also suggested raising the retirement age to align with increasing life expectancies, echoing Fink's sentiments on the need for adjustments to the retirement system.

But that ignores the reality of aging in the workplace, with the AARP finding in a 2022 survey that the majority of workers over 50 say they face ageism at work. And because of ill health or an unexpected job loss, many older Americans stop working before they planned to. In fact, the median age of retirement in the U.S. is 62 — even lower than the "traditional" retirement age of 65.

Fink is right in saying that the retirement system isn't working for most households, noted retirement expert and New School of Research professor Teresa Ghilarducci told CBS MoneyWatch. But his assessment that people should work longer misses the mark, she added.

"After a 40-year-old experiment of a voluntary, do-it-yourself-based pension system, half of workers have no easy way to save for retirement," she said. "And in rich nations, why isn't age 65 a good target for most workers to stop working for someone else?"

She added, "Working longer won't get us out of this. Most people don't retire when they want to, anyway."

Vested interest?

To be sure, America's retirement gap, or the gulf between what people need to fund their golden years versus what they've actually saved, isn't new, nor is Social Security's looming funding emergency. Yet Fink's comments are noteworthy because of his status as the head of the world's largest asset manager, with more than $10 trillion in assets, including many retirement accounts.

Retirement Savings Advocacy

Advocating for increased retirement savings among Americans, a prominent figure in the financial industry has emphasized the importance of securing financial stability for future generations. Highlighting the benefits of bolstering retirement assets, the individual pointed out the advantages of long-term financial planning.

Furthermore, the advocate endorsed a new target-date fund, LifePath Paycheck, set to launch in April by BlackRock. This initiative aims to facilitate smoother retirement planning for individuals, aligning with the broader goal of enhancing financial security.

Promoting Financial Literacy

Encouraging discussions around retirement savings, the advocate underscored the significance of public policy interventions that have successfully addressed similar challenges in other countries. Citing Australia as an example, where a robust retirement system has been established, the advocate emphasized the positive outcomes of such initiatives.

Additionally, the advocate stressed the importance of making retirement investing more accessible and automatic for workers, advocating for streamlined processes that can benefit individuals in the long run.

A Call to Action

Recognizing the responsibility of addressing retirement challenges, particularly for younger generations, the advocate called upon baby boomers to take proactive steps in resolving financial insecurities. Acknowledging the concerns of millennials and Gen Z regarding their financial futures, the advocate highlighted the need for collective action in ensuring a stable retirement landscape for all.

He emphasized the importance of addressing the retirement crisis, stating, "And before my generation fully disappears from positions of corporate and political leadership, we have an obligation to change that."

There is a divide between Boomer (and older) lawmakers and politicians on how to solve the retirement crisis. Fink pointed out that failing to address this issue not only impacts individual Americans' retirements but also undermines the country's collective optimism about the future of the U.S. "We risk becoming a country where people keep their money under the mattress and their dreams bottled up in their bedroom," he warned.